Shareholder

The Group continued to deliver on its shareholder commitments, despite a multitude of challenges stemming from the operating environment. Performance during the year attests to the diversity and resilience of the Group’s earnings profile and its strategic agenda which has positioned the Group for transformational growth. During the year Hayleys delivered a record-breaking Revenue, strong growth in profit generation and impressive shareholder metrics.

Key shareholder metrics

Our Approach to Reporting

As the primary annual communication to capital providers and other stakeholders, the Group’s Integrated Annual Report provides an overview of the Group’s performance and strategic progress for the year and outlook for the future. Key features of this year’s Annual Report include the following:

Leadership and Governance

Mohan Pandithage

Chairman and Chief ExecutiveReflections from Chairman & Chief Executive

“The Group’s performance during the year serves as a clear testament to the strength of its diversified market presence and customer base, which enabled resilience amid an evolving and often unpredictable operating environment”

Download Reflections from Chairman & Chief ExecutiveYou may like

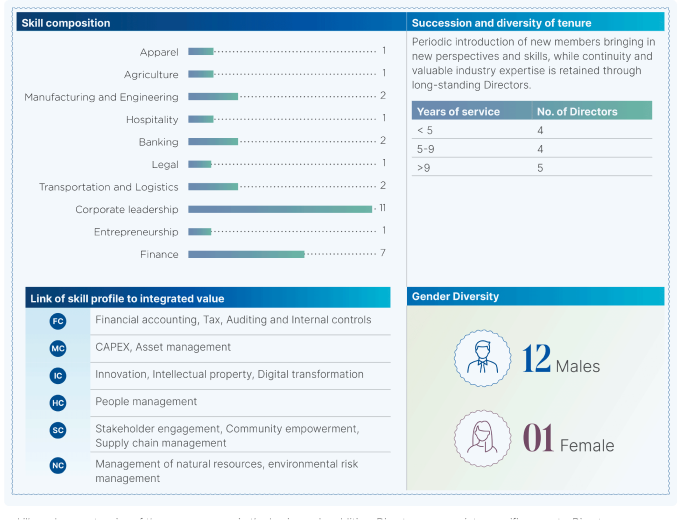

Corporate Governance

The Group’s fit-for-purpose governance frameworks ensure compliance with applicable laws, codes and best practices through effective and adequate controls. The Board ensures that Hayleys is governed through ethical consciousness and integrity thereby preserving the interests of diverse stakeholders and capital resources while guaranteeing accountability and effective leadership

Key highlights in 2024/25

- Change in Board composition- Majority of Directors are Non-Executive, while majority of Non-Executive Directors are Independent

- Appointment of new Directors

- Several policies refreshed and updated in line with the requirements of the new listing rules

- Full compliance to new Listing Rules

Purpose driven Strategy

The Group’s strategy is underpinned by five pillars, formulated by the Strategic Business Development Unit (SBDU) at Hayleys PLC and cascaded to each Sector under the leadership of the Group Management Committee.

- 1Expansion of geographical footprint

- 2Enhancing manufacturing capabilities

- 3Diversification of customer base

- 4Cost management and process automation

- 1Value-added product development

- 2Fulfilling customer requirements on sustainability

- 3Strengthen after-sales service in key verticals

- 4Enhance customer engagement through social media platforms

- 1Implementation of systematic succession plans

- 2Group-wide diversity, equity and inclusion training

- 3Leadership development programmes

- 4Employee engagement

- 1Capacity building across supply chains across key verticals

- 2Strengthened Group Procurement policy

- 3Backward integration and supply chain diversification

- 4Strategic community development initiatives

- 12nd edition of Hayleys Lifecode launched

- 2Sector-level ESG Roadmaps launched by 2 Sectors

- 3Widened computation of Scope 3 GHG emission

- 4Quarterly reporting of ESG metrics

Financial capital

Despite a multitude of challenges that prevailed during the year, the Group demonstrated strong resilience to achieve its highest ever Revenue and strong profitability. The Group remain focused on driving enhanced shareholder value through organic and inorganic growth in the portfolio, operating efficiency and effective margin management.

Consolidated Revenue

13% increase to

Rs.492.20 bn- Revenue growth driven by strong contributions from Consumer & Retail and Transportation & Logistics sectors

- Growth in the domestic businesses countered the adverse implications of the appreciation in the exchange rate which impacted the export-oriented sectors

Earnings Before Interest & Tax

12% increase to

Rs.47.77 bn- Driven by improved profitability in Consumer & Retail and Transportation & Logistics sectors

- Notably the Leisure Sector which had incurred a Loss Before Interest and Tax recorded strong turnaround at EBIT level.

Profit Before Tax

40% increase to

Rs.35.37 bn- The Consumer & Retail was the largest contributor to PBT with a share of 15%, followed closely Transportation & Logistics (15%), Purification (13%), Hand Protection (9%), Textiles (7%) and Projects & Engineering (8%)

Total Assets

16% increase to

Rs.510.69 bn- Asset growth was supported by investments across several key sectors including Transportation & Logistics, Purification, Hand Protection, Textiles and Construction Materials

- Current asset growth of 14% driven by an increase in Trade & Other Receivables

Borrowings

19% increase to

Rs.204.41 bn- Debt profile is dominated by Consumer & Retail, Transportation & Logistics and Others Sector

- Borrowings funded 40% of the Group’s Total Assets

Indicator

Movement

13% increase to

Rs.492.20 bnCommentary

- Revenue growth driven by strong contributions from Consumer & Retail and Transportation & Logistics sectors

- Growth in the domestic businesses countered the adverse implications of the appreciation in the exchange rate which impacted the export-oriented sectors

Movement

12% increase to

Rs.47.77 bnCommentary

- Driven by improved profitability in Consumer & Retail and Transportation & Logistics sectors

- Notably the Leisure Sector which had incurred a Loss Before Interest and Tax recorded strong turnaround at EBIT level.

Movement

40% increase to

Rs.35.37 bnCommentary

- The Consumer & Retail was the largest contributor to PBT with a share of 15%, followed closely Transportation & Logistics (15%), Purification (13%), Hand Protection (9%), Textiles (7%) and Projects & Engineering (8%)

Movement

16% increase to

Rs.510.69 bnCommentary

- Asset growth was supported by investments across several key sectors including Transportation & Logistics, Purification, Hand Protection, Textiles and Construction Materials

- Current asset growth of 14% driven by an increase in Trade & Other Receivables

Movement

19% increase to

Rs.204.41 bnCommentary

- Debt profile is dominated by Consumer & Retail, Transportation & Logistics and Others Sector

- Borrowings funded 40% of the Group’s Total Assets

Portfolio Reviews

Eco Solutions

Download Sector ReportRevenue (Rs. bn)

12.85PBT (Rs. mn)

(524)PAT (Rs. mn)

(520)Assets (Rs. bn)

20.76- Performance impacted by appreciation in Sri Lankan Rupee and escalation in raw material costs, which led to a reduction in Revenue and implications on margins

- Investments in backward integration through investments in a fibre-extraction facility

- Continued investments in value-added products

Hand Protection

Download Sector ReportRevenue (Rs. bn)

46.35PBT (Rs. mn)

3.86PAT (Rs. mn)

3.26Assets (Rs. bn)

42.04- Resilient performance backed up volume growth and penetration in new and existing markets

- Expansion of manufacturing footprint with the acquisition of Hi-Care Thai Gloves Co., Ltd and manufacturing expansion of Hanwella facility

- Strengthening global presence through establishing marketing arms

Purification

Download Sector ReportRevenue (Rs.bn)

42.83PBT (Rs. bn)

5.50PAT (Rs. bn)

4.26Assets (Rs. bn)

42.93- Revenue remained relatively unchanged due to the appreciation of the Sri Lankan Rupee, while Profit Before Tax moderated mainly due to margin contraction from rising coconut-shell charcoal prices in global markets

- The Sector continued to pursue increased contributions from value-added products and geographical expansion

- Strategic emphasis on strengthening supply chain security and resilience through backward integration and diversification of supply chains

Textiles

Download Sector ReportRevenue (Rs. bn)

43.46PBT (Rs. bn)

3.07PAT (Rs. bn)

2.11Assets (Rs. bn)

35.86- Performance impacted by decline in volumes stemming from the deferment of orders from a major customer and appreciation of the Sri Lankan Rupee

- Strategic emphasis on brand diversification with the addition of several exciting, fast-growing brands to the portfolio

- Ongoing focus on transitioning from basic, conventional, cotton-based fabrics to premium, value-added products

Construction Materials

Download Sector ReportRevenue (Rs. bn)

13.11PBT (Rs. bn)

1.14PAT (Rs. mn)

867Assets (Rs. bn)

16.56- Performance upheld by uptick in residential demand and strong growth in export volumes

- Strengthened manufacturing footprint with the commissioning of Ascend- an advanced facility featuring cutting-edge technology and invested in improving technological capabilities

- Successfully obtained the Aluminium Stewardship Initiative (ASI) certification

Plantations

Download Sector ReportRevenue (Rs. bn)

19.18PBT (Rs. bn)

2.91PAT (Rs. bn)

1.91Assets (Rs. bn)

27.28- While Revenue increased led by growth in crops and prices, profitability was impacted by the sharp increase in wages and other costs

- Talawakelle Tea Estates commissioned a state-of-the art tea factory in Kiruwanaganga

- The three RPCs continue to lead the industry in sustainability, innovation and quality, emerging as top price takers in the Colombo Tea Auction.

Agriculture

Download Sector ReportRevenue (Rs. bn)

37.51PBT (Rs. bn)

2.60PAT (Rs. bn)

1.5Assets (Rs. bn)

29.33- The Sector delivered a resilient performance, through leveraging the diversity of its businesses geographical footprint and global partnerships.

- Continued focus on expanding product offering in Bangladesh

- Diversification of business lines with the entry into frozen coconut water

Consumer & Retail

Download Sector ReportRevenue (Rs. bn)

108.48PBT (Rs. bn)

6.53PAT (Rs. bn)

4.39Assets (Rs. bn)

124.47- Singer achieved record-breaking profitability during the year supported by the more conducive market conditions and timely market activations across its network

- Widened the product and brand portfolio while pursuing diversification of customer segments

- Ongoing focus on upgrading showrooms and enhancing the customer experience

Leisure

Download Sector ReportRevenue (Rs. bn)

9.65PBT (Rs. mn)

(521)PAT (Rs. mn)

(627)Assets (Rs. bn)

19.78- Sector’s overall performance was upheld by the record-breaking profitability of the Sri Lankan properties, with all four properties generating profits for the first time. Overall profitability however, continued to be impacted by Amaya Kuda Rah Maldives,

Industry Inputs, Power & Energy

Download Sector ReportRevenue (Rs. bn)

11.10PBT (Rs. bn)

2.16PAT (Rs. bn)

1.71Assets (Rs. bn)

17.05- Sector delivered commendable performance during the year, reflecting improved profitability in both Industry Inputs and Power & Energy clusters

- Secured a tender to construct and operate a 4MW ground-mounted solar project

- Industrial Raw Materials performed well during the year, reflecting increased contributions from value-added products.

Transportation & Logistics

Download Sector ReportRevenue (Rs. bn)

106.84PBT (Rs. bn)

6.51PAT (Rs. bn)

3.72Assets (Rs. bn)

82.42- The Sector recorded significant improvements in Revenue and Profitability supported by more conducive conditions and broad-based improvements across clusters

- Strategic focus on establishing the geo-product organisational structure for focused regional expansion

- Expansion of the marine fleet with the addition of 3 vessels during the year

Projects & Engineering

Download Sector ReportRevenue (Rs. bn)

26.62PBT (Rs. bn)

3.33PAT (Rs. bn)

2.37Assets (Rs.bn)

27.38- The Sector’s overall performance moderated due to the global decline in solar panel prices, although the Sector maintained its leadership position in solar EPC segment

- Secured a contract to develop a 50 MW wind power plant in Mannar, along with 37 ground-mounted solar projects amounting to 149 MWM

- Partnered with BYD, the global leader in Battery Energy Storage systems, to launch advanced energy storage and inverter solutions in Sri Lanka

Tea Exports

Download Sector ReportRevenue (Rs.bn)

13.16PBT (Rs. mn)

616PAT (Rs.mn)

468Assets (Rs.bn)

5.59- Despite a growth in Revenue, both companies recorded a moderation in profits reflecting the appreciation of the exchange rate

- The Sector pursued geographical diversification while Mabroc’s Kenyan subsidiary which completed its first full year of operations demonstrated encouraging results

Key developments

Revenue (Rs. bn)

Rs.12.85PBT (Rs. mn)

(524)PAT (Rs. mn)

(520)Assets (Rs. bn)

20.76Way forward priorities

- Performance impacted by appreciation in Sri Lankan Rupee and escalation in raw material costs, which led to a reduction in Revenue and implications on margins

- Investments in backward integration through investments in a fibre-extraction facility

- Continued investments in value-added products

Revenue (Rs.bn)

46.35PBT (Rs. mn)

3.86PAT (Rs.mn)

3.26Assets (Rs.bn)

42.04Way forward priorities

- Resilient performance backed up volume growth and penetration in new and existing markets

- Expansion of manufacturing footprint with the acquisition of Hi-Care Thai Gloves Co., Ltd and manufacturing expansion of Hanwella facility

- Strengthening global presence through establishing marketing arms

Revenue (Rs. bn)

42.83PBT (Rs. bn)

5.50PAT (Rs. bn)

4.26Assets (Rs. bn)

42.93Way forward priorities

- Revenue remained relatively unchanged due to the appreciation of the Sri Lankan Rupee, while Profit Before Tax moderated mainly due to margin contraction from rising coconut-shell charcoal prices in global markets

- The Sector continued to pursue increased contributions from value-added products and geographical expansion

- Strategic emphasis on strengthening supply chain security and resilience through backward integration and diversification of supply chains

Revenue (Rs. mn)

43.46PBT (Rs. bn)

3.07PAT (Rs. bn)

2.11Assets (Rs. bn)

35.86Way forward priorities

- Performance impacted by decline in volumes stemming from the deferment of orders from a major customer and appreciation of the Sri Lankan Rupee

- Strategic emphasis on brand diversification with the addition of several exciting, fast-growing brands to the portfolio

- Ongoing focus on transitioning from basic, conventional, cotton-based fabrics to premium, value-added products

Revenue (Rs. bn)

13.11PBT (Rs. bn)

1.14PAT (Rs. mn)

867Assets (Rs. bn)

16.56Way forward priorities

- Performance upheld by uptick in residential demand and strong growth in export volumes

- Strengthened manufacturing footprint with the commissioning of Ascend- an advanced facility featuring cutting-edge technology and invested in improving technological capabilities

- Successfully obtained the Aluminium Stewardship Initiative (ASI) certification

Revenue (Rs. bn)

19.18PBT (Rs. bn)

2.91PAT (Rs. bn)

1.91Assets (Rs. bn)

27.28Way forward priorities

- While Revenue increased led by growth in crops and prices, profitability was impacted by the sharp increase in wages and other costs

- Talawakelle Tea Estates commissioned a state-of-the art tea factory in Kiruwanaganga

- The three RPCs continue to lead the industry in sustainability, innovation and quality, emerging as top price takers in the Colombo Tea Auction.

Revenue (Rs. bn)

37.51PBT (Rs. bn)

2.60PAT (Rs. bn)

1.5Assets (Rs. bn)

29.33Way forward priorities

- The Sector delivered a resilient performance, through leveraging the diversity of its businesses geographical footprint and global partnerships.

- Continued focus on expanding product offering in Bangladesh

- Diversification of business lines with the entry into frozen coconut water

Revenue (Rs. bn)

108.48PBT (Rs. bn)

6.53PAT (Rs. bn)

4.39Assets (Rs. bn)

124.47Way forward priorities

- Singer achieved record-breaking profitability during the year supported by the more conducive market conditions and timely market activations across its network

- Widened the product and brand portfolio while pursuing diversification of customer segments

- Ongoing focus on upgrading showrooms and enhancing the customer experience

Revenue (Rs. bn)

9.65PBT (Rs. mn)

(521)PAT (Rs. mn)

(627)Assets (Rs. bn)

19.78Way forward priorities

- Sector’s overall performance was upheld by the record-breaking profitability of the Sri Lankan properties, with all four properties generating profits for the first time. Overall profitability however, continued to be impacted by Amaya Kuda Rah Maldives,

Revenue (Rs. bn)

11.10PBT (Rs. bn)

2.16PAT (Rs. bn)

1.71Assets (Rs.bn)

17.05Way forward priorities

- Sector delivered commendable performance during the year, reflecting improved profitability in both Industry Inputs and Power & Energy clusters

- Secured a tender to construct and operate a 4MW ground-mounted solar project

- Industrial Raw Materials performed well during the year, reflecting increased contributions from value-added products.

Revenue (Rs. bn)

106.84PBT (Rs. bn)

6.51PAT (Rs. bn)

3.72Assets (Rs. bn)

82.42Way forward priorities

- The Sector recorded significant improvements in Revenue and Profitability supported by more conducive conditions and broad-based improvements across clusters

- Strategic focus on establishing the geo-product organisational structure for focused regional expansion

- Expansion of the marine fleet with the addition of 3 vessels during the year

Revenue (Rs. bn)

26.62PBT (Rs. bn)

3.33PAT (Rs. bn)

2.37Assets (Rs. bn)

27.38Way forward priorities

- The Sector’s overall performance moderated due to the global decline in solar panel prices, although the Sector maintained its leadership position in solar EPC segment

- Secured a contract to develop a 50 MW wind power plant in Mannar, along with 37 ground-mounted solar projects amounting to 149 MWM

- Partnered with BYD, the global leader in Battery Energy Storage systems, to launch advanced energy storage and inverter solutions in Sri Lanka

Revenue (Rs.bn)

13.16PBT (Rs. mn)

616PAT (Rs.mn)

468Assets (Rs.bn)

5.59Way forward priorities

- Despite a growth in Revenue, both companies recorded a moderation in profits reflecting the appreciation of the exchange rate

- The Sector pursued geographical diversification while Mabroc’s Kenyan subsidiary which completed its first full year of operations demonstrated encouraging results

Risks and Opportunities

Economic

2025

92024

9- Reduce dependency on domestic market through expanding export-orientation

- Maintain strong relationships with stakeholders, lobby groups and banks

Liquidity and financial stability

2025

92024

9- Improve liquidity risk oversight by Board and GMC

- Derive Group synergies to manage borrowings

- Diversify funding sources

Geopolitical risk

2025

62024

4- Pursuing increased diversification of export markets, particularly in non-traditional markets

- Focused growth in selected markets

- Value-added product propositions which are relatively price

Data protection and cybersecurity risks

2025

62024

6- IT governance policies and structures in place

- Regular employee awareness on mitigating cybersecurity risks

- Robust Business Continuity Plan in place

Physical risks of climate change

2025

62024

6- Close monitoring of weather patterns and potential impacts

- Climate adaptation measures

- Strengthen environmental management systems through certifications

Transitional risks of climate change

2025

62024

6- Close engagement with customers on identifying and responding to sustainability-related demands

- Gradual transition to renewable energy sources

- Environmental targets centered on emission reductions, water consumption and waste management

Risk

Risk Rating

2024

92025

9Mitigation

- Reduce dependency on domestic market through expanding export-orientation

- Maintain strong relationships with stakeholders, lobby groups and banks

Risk Rating

2024

92025

9Mitigation

- Improve liquidity risk oversight by Board and GMC

- Derive Group synergies to manage borrowings

- Diversify funding sources

Risk Rating

2024

42025

6Mitigation

- Pursuing increased diversification of export markets, particularly in non-traditional markets

- Focused growth in selected markets

- Value-added product propositions which are relatively price

Risk Rating

2024

62025

6Mitigation

- IT governance policies and structures in place

- Regular employee awareness on mitigating cybersecurity risks

- Robust Business Continuity Plan in place

Risk Rating

2024

62025

6Mitigation

- Close monitoring of weather patterns and potential impacts

- Climate adaptation measures

- Strengthen environmental management systems through certifications

Risk Rating

2024

62025

6Mitigation

- Close engagement with customers on identifying and responding to sustainability-related demands

- Gradual transition to renewable energy sources

- Environmental targets centered on emission reductions, water consumption and waste management

Way Forward

Portfolio Optimisation

- Export-oriented sectors will seek to diversify its markets with increasing focus on non-traditional markets

- Increase contributions from value-added products, thereby reducing exposure to price competitive offerings

- Pursuing diversification of funding sources Optimising working capital with the aim of reducing inventory-build up

Customer Centricity

- Focus on customised solutions to sharpen competitive edge and customer loyalty

- Active engagement in trade fairs and exhibitions

- Aggressively seeking new customer acquisition in regional markets

Inclusive business models

- Continued focus on prioritising inclusive supply chains which accelerate positive social and environmental impact

- Screening suppliers on environmental and social criteria

Customer Centricity

- Succession planning across sectors to build effective talent pipelines

- Creating a respectful and inclusive workplace through ongoing training and engagement interventions

- Ongoing investments in training and development

ESG integration

- Completion of Sector-level ESG roadmaps across all Sectors

- Ongoing focus on strengthening ESG governance and reporting mechanisms

- Initiatives across all six pillars aligned to the aspirations of the Hayleys Lifecode